Instantly Shop & Compare With 80+ Of America's Top Insurers

Our process is simple, hassle-free and takes just minutes. We instantly shop and compare options and prices among 80+ of America's top insurers to find the best rates available for you, saving you 50% or more. Have questions? Our experienced licensed Agents are available to help you.

What Do You Want To Protect Today?

The Coverage You Need In 3 Simple Steps

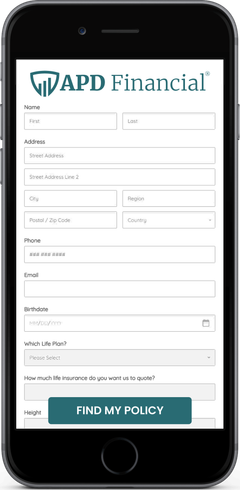

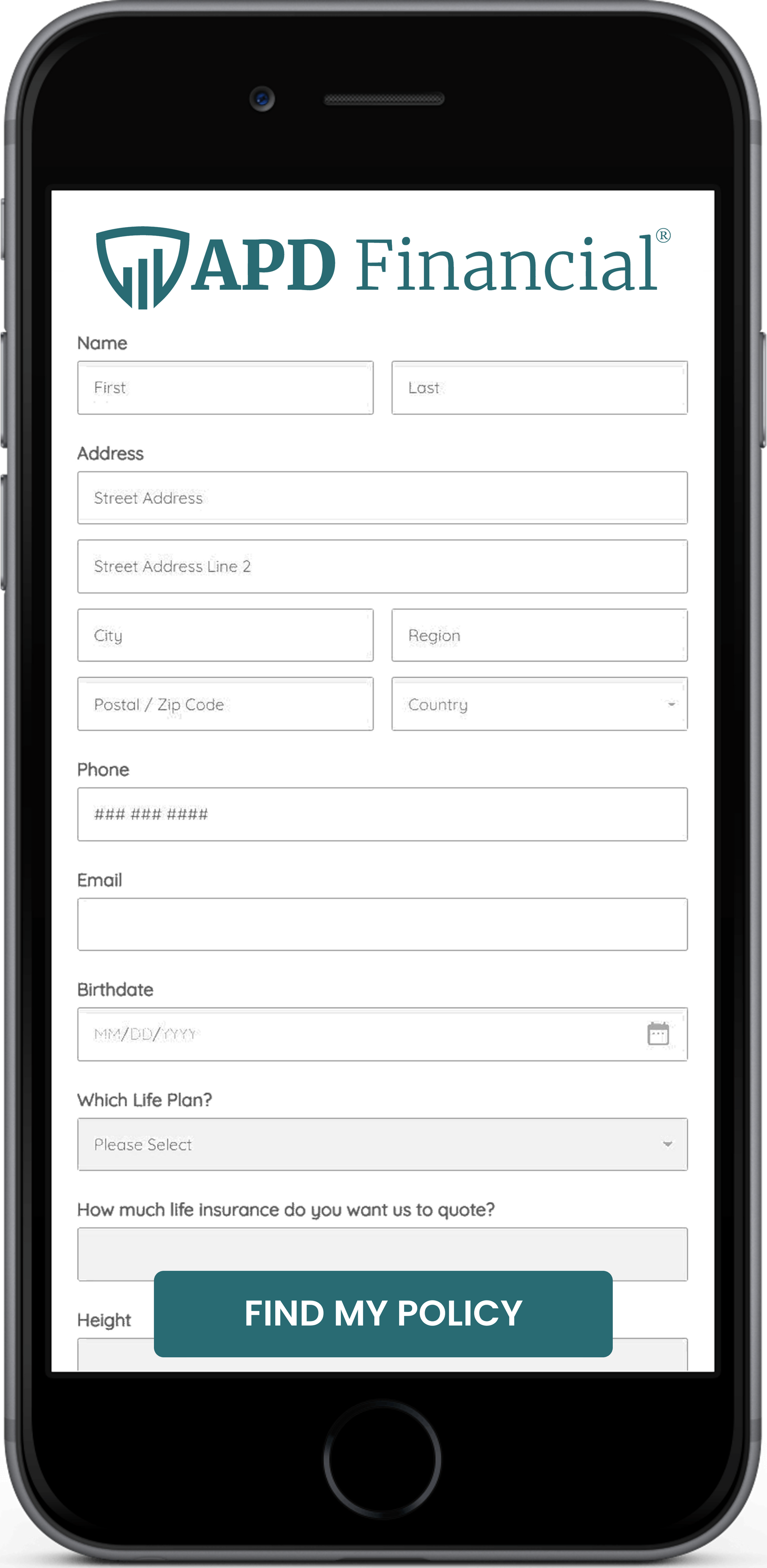

Find My Policy

Tell us about yourself and we will match you with available life insurance solutions that meet your needs and fit your budget.

Get A Quote

Select the solution that works best for you. We have made it easy to get a quote online or connect with one of our Agents.

Apply & Buy

Check life insurance off your to-do list! We'll walk you through the application and purchasing process. Coverage often starts on the same day.

Apply & Buy

Check life insurance off your to-do list! We'll walk you through the application and purchasing process. Coverage often starts on the same day.

Find My Policy

Tell us about yourself and we will match you with available life insurance solutions that meet your needs and fit your budget.

Get A Quote

Select the solution that works best for you. We have made it easy to get a quote online or connect with one of our Agents.

Apply & Buy

Check life insurance off your to-do list! We'll walk you through the application and purchasing process. Coverage often starts on the same day.

Find My Policy

Tell us about yourself and we will match you with available life insurance solutions that meet your needs and fit your budget.

Affordable Life Insurance Quotes Without A Medical Exam

Are you in need of affordable, same-day life insurance that fits your budget? Look no further! We offer exclusive no-medical exam life insurance options up to $2 million with fully underwritten rates that won't break the bank. The application process is quick and easy, taking less than an hour to complete. With some policies costing less than $1 a day, you can have peace of mind without the financial burden. If you're 60 years or younger and in good health, you can get coverage that starts immediately.

Frequently Asked Questions

-

Why Should I Choose APD Financial?

We make applying for life insurance simple. Traditionally, applications might take weeks and often involves confusing paperwork and lengthy medical exams.

With APD Financial, selecting and applying for the right life insurance coverage is fast, simple, and affordable.

APD Financial can be your one-stop for life insurance, retirement, legacy planning and more! Our difference is our passion for protecting families—like yours—and matching you with the best carrier and coverage for you. We can compare coverage and prices from 80+ of the most trusted insurance companies in the time it takes you to get a quote from one. Our licensed and experienced Agents are available to provide guidance to help you get covered with confidence.

-

Do You Provide Free Quotes?

Yes, the quote is always free at APD Financial and there’s never an obligation to purchase or enroll. In addition, our licensed and experienced Agents are available to guide you through the often confusing options available to ensure that you get the right coverage for the best price for you and your family. We’re an independent insurance broker, meaning we're not owned by an insurance company, nor do we own one. Instead, we sell insurance policies from multiple insurers without bias or favor toward any of them. It’s important to us that we help you find the right insurance policy for your needs — not which company you buy it from.

-

Is It Less Expensive To Purchase From APD Financial?

Insurance rates are regulated by law, which means that no company, broker, or agent can offer you a discount on a policy. That doesn't mean you can't find ways to save money, though! Each insurer calculates risk differently, and they all strive to offer policies at competitive prices. That's why APD Financial helps you compare quotes from multiple companies in one place: to make it easy to spot potential savings.

-

If Life Insurance Really Worth It?

The thought of purchasing a life insurance policy can be intimidating, but it's not only valuable for peace of mind, it's often more cost-effective than anticipated. The high coverage amounts associated with life insurance may lead one to believe they are costly. However, in most cases, the reality is that they're quite affordable.

Life insurance comes in two primary forms: term and permanent. Term life insurance is usually the less expensive alternative and offers significant flexibility to match your specific needs and financial constraints. With this plan, you select a fixed coverage duration—typically 10, 15, 20, 25 or 30 years. If an unforeseen event occurs during this period resulting in death, your family receives a death benefit. With permanent life insurance, you are guaranteed to never outlive your policy and your policy accumulates cash value which provides flexibility in the future. This financial safety net could substantially impact your family's future stability if you're the main breadwinner.

We aid in identifying suitable coverage and amount by partnering with reputable insurers, providing speedy cost and coverage comparisons for finding the right-fit insurance at the best price.

-

How Much Life Insurance Do I Need?

The quick math is 10x your salary. It may sound like a lot, but think of everything it could be used to cover: a mortgage, debt, higher education, an emergency fund, and more. For a personalized answer to this question, meet with one of our Agents.

A common and easy way to come up with a coverage estimate is to multiply your annual income by 10. Another way is to calculate your long-term financial obligations and then subtract your assets. The remainder is the gap that life insurance needs to fill. It can be difficult to know what to include in your calculations, so we recommend meeting with one of our Agents to help you dettermine your coverage needs.

-

But I Have Insurance Through My Employer...Isn’t That Enough?

Employer-sponsored policies typically offer coverage that is about 1-2X your annual salary, which is a fraction of the coverage you need. Financial experts recommend having coverage that is about 10X your salary, which is why many people buy individual term policies to supplement their coverage through work.

If you have group life insurance through work, you may be paying too much for not enough coverage. How much life insurance (and what kind of insurance) is needed varies from person to person. Our life insurance agents can help you figure out what coverage is best for you and your family—be it term life insurance, whole life insurance, or another policy altogether. Call an APD Financial licensed insurance agent today to learn more about your options.

-

Who Can I Talk To If I Need Help?

Each member of our customer experience team is a licensed and experienced Agent. They’ll answer any questions you may have and help you get the right policy for you.

Ready To Get Started?

Find the coverage you need and save by shopping from 80+ of the most trusted insurance companies. Our Agents have been helping families find the right life insurance for over 20 years.

We talk to you about your specific situation and what kind of coverage you want. Then, we find the best life insurance company for you, thinking about things like your lifestyle and health. In just a few minutes, we can give you quotes from good companies that fit your budget.

Contact

382 NE 191st St

Miami, FL 33179

(800) 266-6440

Privacy Policy | Legal | Disclosures | Accessibility

APD Financial, LLC (“APD Financial”), a Florida corporation with its principal place of business in Miami, FL, is a licensed independent insurance broker. The information provided on this site has been developed by APD Financial for general informational and educational purposes. We do our best to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Annuity guarantees are based on the claims-paying ability of the issuing insurance company. Any examples provided are hypothetical. Annuities are issued with prospectus and sales brochures and should be reviewed carefully before funding as features and benefits vary.

©2024 APD Financial. All Rights Reserved